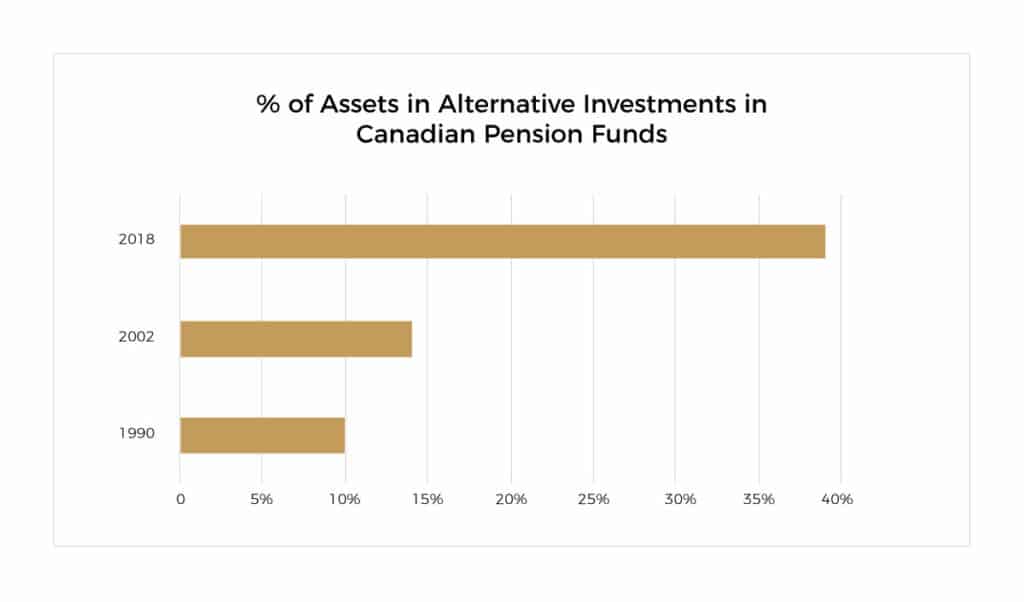

Canadian Pension Plans have increased their investments in alternative assets from 10% to 39% since 1990.

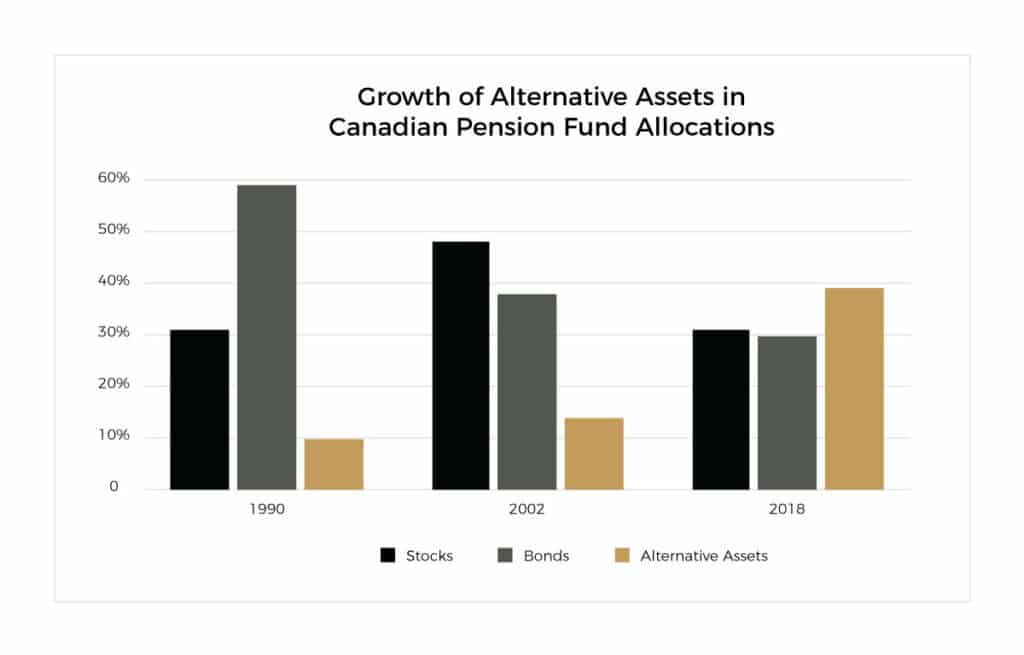

Today alternative assets are a larger portion of Pension Funds asset mix than stocks. Similar trend is also observed in the US endowment funds and Pension funds.

Over the past 30 years, there has been a noticeable increase in assets in Alternative Investments in Canadian Pension Funds.

Proportion of each asset in the Canadian Pension Fund, moving from stocks and bonds to alternative assets.

What are alternative assets?

Broadly speaking, an alternative asset is any asset that is not in traditional stocks, bonds or cash. There are a variety of different vehicles and instruments to invest in alternative assets classes and they each carry varying degrees of risk.

Some of the major categories of alternative investments are:

1. Commodities

2. Real Estate – by far the largest

3. Hedge Funds

4. Private Equity

Alternative investments provide an avenue to boost return and create diversity in the portfolio. In the case of Real Estate, it can also be one of the only vehicles for hedging against inflation.

You might also like

About Aultrust Financial

Aultrust is a financial and real estate development organization, combining finance with development to help build distinctive communities. Aultrust takes its name from a deep-rooted conviction to principles of integrity, good-will, and social responsibility.

Shall you have any questions regarding the above, please reach out to us by filling in the form below.