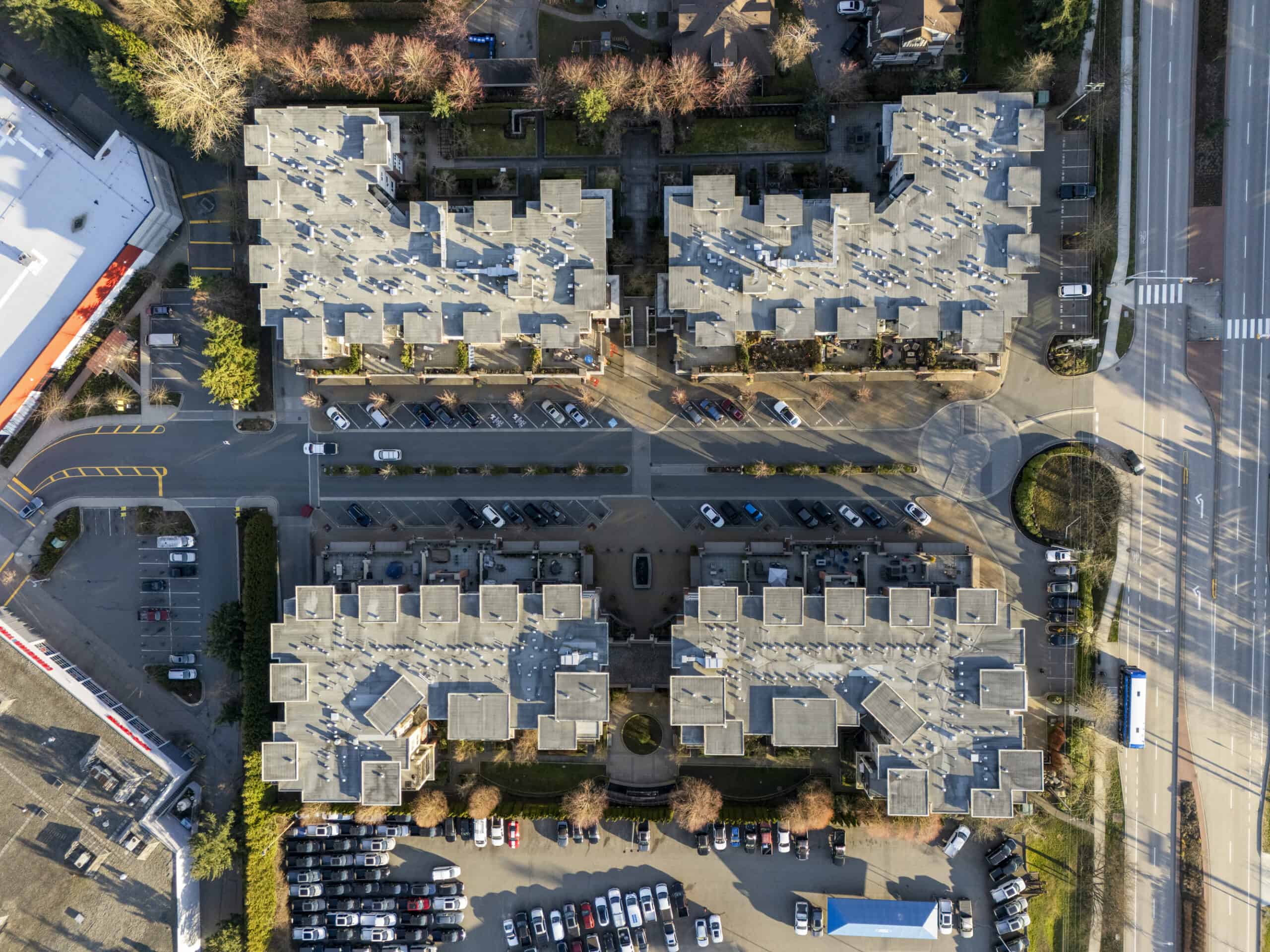

Through our real estate development partnership with SwissReal, Aultrust offers individual funds tailored to different types of real estate assets, including income-generating properties, holdings, and medium-term equity investments. Each fund is designed to capitalize on opportunities within the diverse asset classes of Metro Vancouver’s dynamic real estate market.

Our offerings include:

Key features of our real estate investment funds include:

Units of the fund may be purchased directly through Aultrust Financial, please contact Investor Services at:

T: 604.336.9021

Must meet eligibility criteria.

For more information, please contact us using the form below.

Dive into the future of finance by investing with LendCore. Our cutting-edge technology is reshaping mortgage lending, making it smarter, faster, and more accessible. Join us in revolutionizing the lending industry—your opportunity to impact and profit from financial innovation is just a click away.

Learn More →

DISCLOSURE

The information relating to the Fund presented on this website has not been audited and may be calculated and presented differently from similar information in other sources.

The material on this website is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. After the initial offering, shares are sold on the private market. Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Investment policies, management fees and other matters of interest to prospective investors may be found in each closed-end fund report. For additional information, please contact your investment professional.

Shares of closed-end funds frequently trade at a discount to their net asset value, which may increase risk of loss. The risk may be greater for investors expecting to sell their shares in a relatively short period after completion of the fund’s initial offering.

As with any security, the price of the fund’s common units will fluctuate with market conditions and other factors. Shares of closed-end management investment companies frequently trade at a price that is less than (a “discount”) or more than (a “premium”) from their net asset value. If the fund’s shares trade at a premium to net asset value, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to net asset value thereafter. Additionally, the fund’s distribution rate may be affected by numerous factors, including changes in realized and projected market returns, fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in the fund distribution rate at a future time.

Total net asset value (NAV) return measures the change in NAV per unit over the period indicated. Total market value return is computed based upon the Fund’s underlying assets valuations and excludes the effects of brokerage commissions.